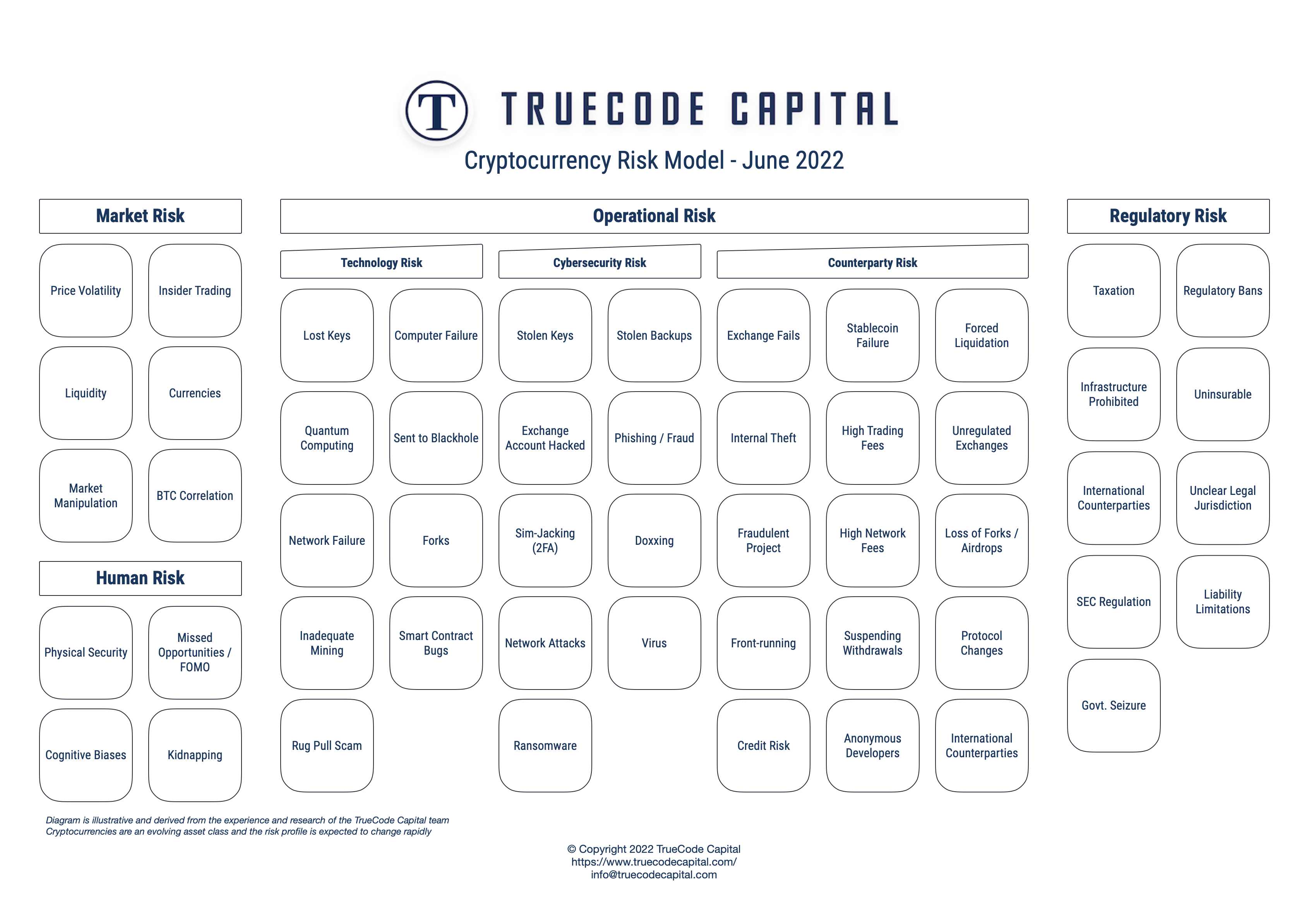

Our cryptocurrency risk model has informed our investment strategies and more importantly, the design of our fund. By focusing on a more complete risk profile for digital assets, we have avoided many of the pitfalls that have bankrupted other crypto funds.

We are happy to share our cryptocurrency risk model with the industry in hopes that others may find it useful as one factor to consider when constructing their cryptocurrency allocations.

Our overarching philosophy is that if crypto risks can be well managed that the industry holds great opportunity. But to manage the risks, we must enumerate them and manage each one in turn.

Market Risk

Market risks are generally the best understood crypto risks. They are familiar from other assets and include commonly reported metrics such has the daily change in price, how much trading volume exists, and how ethically other market participants are behaving.

Operational Risk

The operational risks of a cryptocurrency portfolio are emergent and as complete as we have tried to be with our model, it will always be incomplete as the asset class evolves. That said, we have broken down operational risks into three major categories:

Technology Risk – The risk that stems from the fact that cryptocurrencies rely on underlying software

- Cybersecurity Risk – The risks that arise from the fact that cryptocurrencies operate on peer-to-peer networks

- Counterparty Risks – The risks that come from other parties in the crypto industry, primarily digital asset exchanges

- Technology Risk – First and foremost, cryptocurrency projects are open-source software projects, so all of the technology risks that can befall a software project must be considered. It makes little difference if you have a perfect trading algorithm if the software that underpins the crypto asset has bugs that cause you to lose everything.

In any software development community, you would look for highly qualified developers and a robust community of users who are actively improving the software over time.

Cybersecurity Risk

But cryptocurrency projects are not software run in isolation, rather these software projects operate complex peer-to-peer networks where groups of participants reach consensus on which blocks are added to the blockchain and what the rules for the digital asset will be.

So all the typical risks of internet-connected software should be considered as well as the risk that the network becomes unpopular and ceases operations.

Counterparty Risk

When considering counterparty risks, there are two primary threats:

- Exchange or third-party custody counterparties

- Cryptocurrency project teams

Whether the counterparty risk arises from the software development team, the network participants, the service providers, the exchanges, third-party software providers, or professional services providers; the counterparty attack surface is tremendous. Although Bitcoin was designed to be a trust-less digital currency, the cryptocurrency industry requires tremendous trust between parties.

Any one party who fails to fulfill their obligation can cause a cascade of failures and losses for investors.

Human Risk

Human risks arise from the fact that we do not live on the internet. In fact, for all our high technology, people are flawed and irrational. They fall prey to cognitive biases, they can be physically harmed, they get tired, over-exuberant, or greedy.